BTC halving: what occurs, why, and when

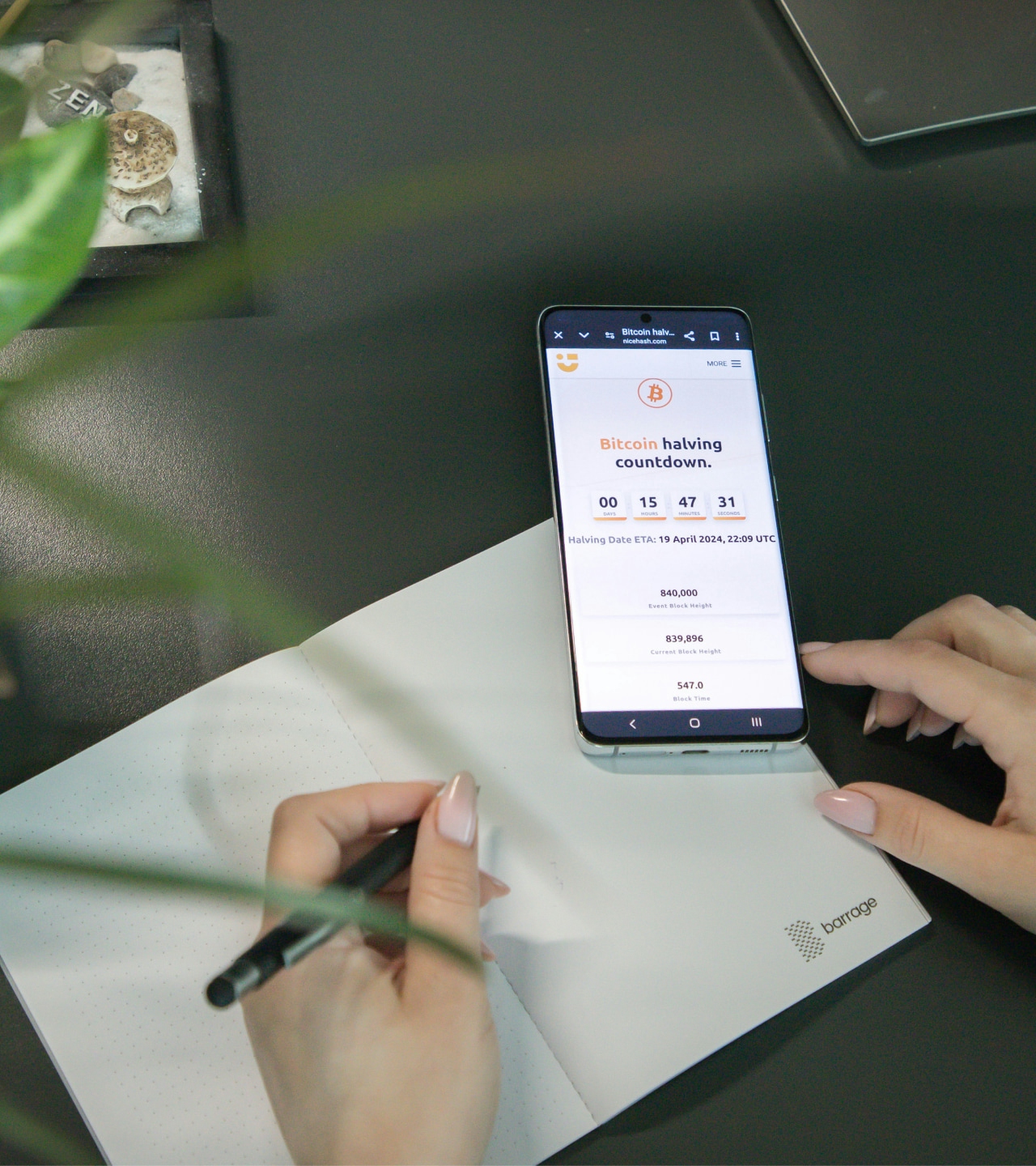

Due to the BTC halving occurring on April 20, 2024, we dedicate a short story on what BTC halving is, why it happens, its causes, and its recurrence interval.

It's that time already. A new Bitcoin halving is at our doorstep! However, to understand its causes and consequences, we need to start from the beginning.

Bitcoin is the world's first decentralized digital currency. It was presented in 2008's whitepaper: "Bitcoin: A Peer-to-Peer Electronic Cash System" by Satoshi Nakamoto as an alternative payment method that goes around financial institutions.

In short, it resolves the double spending problem by combining the digital signatures with the peer-to-peer network that timestamps the hash-based proof-of-work chain that cannot be changed without redoing the proof-of-work.

What is halving?

Bitcoin halving is a programmed event that occurs after every 210,000 blocks are mined. It's like a built-in control system that maintains Bitcoin's value by gradually reducing the rewards for miners.

This is achieved by adjusting the production of an average of one block every 10 minutes. To achieve that, mining difficulty is adjusted after every 2,016 blocks (on average, that’s every two weeks). That allows consistent block time, regardless of network hash power changes.

With a total cap of 21 million Bitcoins, this gradual reduction ensures a controlled supply.

Satoshi’s rule regarding halvings ensures Bitcoin's long-term feasibility and functionality. Bitcoin is an open-source code that can be modified while applying the ground rules mentioned above. An open-source policy applies changes with consensus, and that allows Bitcoin to be relevant in the future and to adapt to any future change it may face.

Halving history and price impacts

Halving is not an event that only impacts Bitcoin.

According to CoinMarketCap, the Global crypto market cap is around 2,4 trillion US dollars, while Bitcoin holds around 1,3 trillion US dollars - a 54% share. Changes to the Bitcoin, good or bad, can impact the entire market.

Halvings directly impact Bitcoin’s supply by reducing the rate at which it is created, thus creating a scarcity effect. As new miners can try to join to earn their share, some old machines can become unprofitable. These factors can force some miners to reassess profitability. To save their profit, they may move from Bitcoin to altcoins, either as a diversification option or a way to continue to use machines that are no longer profitable while mining for Bitcoin. With proof-of-work coins, there is a direct correlation between Bitcoin mining difficulty and altcoin value.

While not guaranteed, historical data shows significant price growths for Bitcoin following each halving. It usually occurs six to twelve months after halving, but that rule was broken in March 2024 when BTC reached the new ATH.

In 2009, the Bitcoin reward for mining was 50 BTC. Previous halving dates were:

- November 28, 2012, to 25 BTC

- July 9, 2016, to 12.5 BTC

- May 11, 2020, to 6.25 BTC

- April 20, 2024 to 3.125 BTC

At the time of writing this blog, the amount of 19.686,875 BTC was mined.

The best is yet to come

In the crypto world, Bitcoin's halving is an important event connected to an entire ecosystem. It can catalyze broader crypto market movements. Bitcoin is an asset in a volatile environment with high risk and a potential for even higher rewards. Although you will not see the changes immediately after the halving, they will happen and impact the entire crypto world.

Hey, you! What do you think?

They say knowledge has power only if you pass it on - we hope our blog post gave you valuable insight.

If you want to share your opinion or have any questions regarding the crypto world or mining, cryptocurrencies or blockchain related, feel free to contact us.

We'd love to hear what you have to say!